Online Payment Solutions Can Be Fun For Everyone

Wiki Article

Some Known Questions About Clover Go.

Table of ContentsThe Best Strategy To Use For Merchant ServicesPayment Hub - TruthsRumored Buzz on Online Payment SolutionsFacts About Online Payment Solutions UncoveredVirtual Terminal for BeginnersThe Facts About Payment Solutions Revealed

Have you ever questioned what happens behind the scenes when an on-line repayment is made? If you are just starting with business of e, Commerce as well as on-line repayments or if you are just interested regarding the process it can be challenging to browse the complicated terms used in the sector and also make feeling of what each star does and just how.

: Read this write-up to obtain everything you require to find out about online settlement handling costs. Let's begin with the merchant the individual that supplies products or solutions to buy. A vendor is anyone or company that offers products or services. An e, Business merchant refers to a celebration who offers items or services with the Internet.

You're possibly questioning what an acquiring bank is well, it's a financial institution or financial organization that is a signed up participant of a card network, such as Visa or Master, Card, as well as approves (or gets) transactions for merchants, in behalf of the debit as well as debt card networks. We'll cover this in even more information later in this post - payeezy gateway.

The 10-Second Trick For Credit Card Processing Fees

A for a certain seller. This account number is similar to various other distinct account numbers released by a financial institution (like a checking account number), but is specifically utilized by the vendor to determine itself as the proprietor of the deal details it sends out to the bank, as well as the recipient of the funds from the transactions.

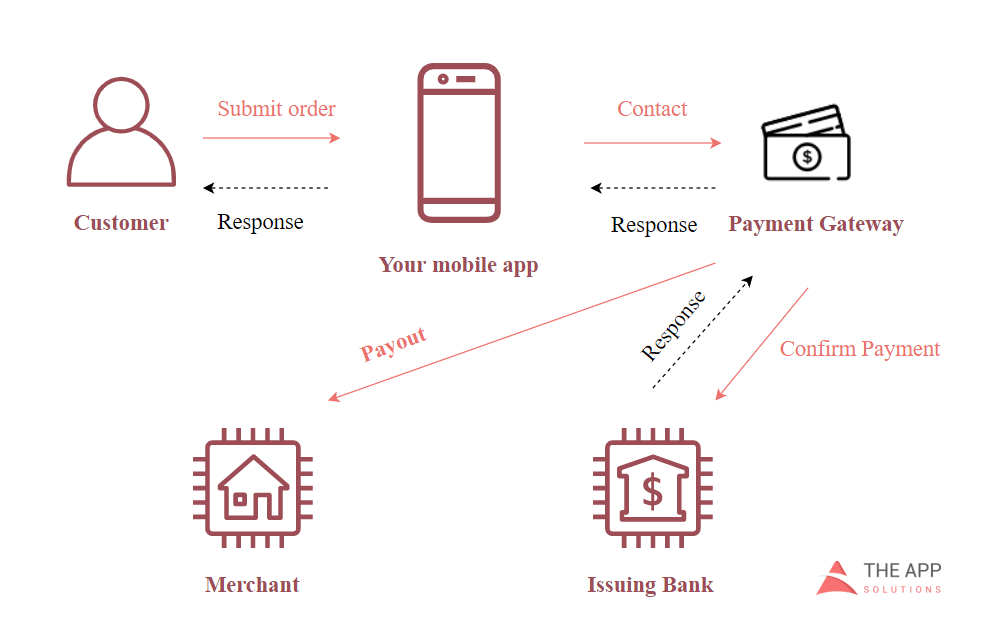

As soon as the merchant has actually acquired a seller account, whenever a client acquisitions an item with a credit rating or debit card, the seller sends the purchase transaction info to the payment cpu utilized by its acquiring bank using a repayment gateway. A repayment gateway is a software program that helps with the communication of transaction information.

Payment Solutions Fundamentals Explained

Visa, Mastercard, etc). The (e. g. when it comes to American Express) or speak to the card's releasing bank for consent (in the instance of Visa/Master, Card). A providing bank is any type of bank or banks that gives (or concerns) credit history or debit cards, via card organizations. Exactly how Does an Issuing Bank Work? An releasing financial institution is accountable for any kind of card owner's capability to settle the debt s/he gathers with the bank card or line of credit history offered by the bank.An acquiring bank is a financial institution or banks stripe credit card processing that accepts debit Learn More Here or credit rating card deals for a cardholder. Just how Does a Getting Financial Institution Work? Acquirers/Acquiring banks are registered members of a card network, such as Master, Card or Visa, and accept (or obtain) purchases in behalf of those debit and bank card networks, for a seller (payment hub).

Whenever a cardholder uses a debit or credit history card for a purchase, the getting financial institution will certainly either accept or decrease the deals based on the information the card network as well as providing bank have on record about that card owner's account. Other than handling deals, an acquirer likewise presumes complete threat and also duty related to the purchases it processes.

The Ultimate Guide To Virtual Terminal

The releasing financial institution after that connects the result (approved/declined) and the factor for it back to the settlement cpu, which will certainly subsequently communicate it to the vendor and buyer through the repayment entrance. If the deal is authorized, after that the amount of the deal is subtracted from the card owner's account as well as the cardholder is offered an invoice.The following action is for the merchant to fulfill the order put by the buyer. After the vendor has met the order, the releasing bank will clear the authorization on the consumer's funds and prepare for purchase settlement with the merchant's getting financial institution. Charge Card Interchange is the procedure in which an acquirer or acquiring bank submits approved card deals in behalf of its merchants.

All About Payeezy Gateway

The obtaining financial institution after that sends out purchase negotiation demands to the shoppers' issuing banks involved. Once all authorizations have actually been made and also all authorizations gotten by the included celebrations, the providing bank of the buyer sends funds to the seller's getting financial institution, using that financial institution's repayment cpu.This is called a settlement pay or negotiation. For regular card purchases, also though the consent and intuit pymt soln also authorization for order satisfaction take only secs, the entire settlement processing circuit behind-the-scenes can take up to 3 days to be finished. And also there you have it how the payments market works, essentially.

Learn about extra terms and also ideas around on the internet payment handling by reading this complete guide.

Facts About Merchant Services Revealed

Referred to as the cardholder's monetary organization. An Acquirer is a Visa/ Master, Card Affiliated Bank or Bank/Processor partnership that remains in business of refining bank card deals for businesses as well as is constantly Obtaining brand-new vendors. A vendor account has a range of charges, some periodic, others billed on a per-item or percentage basis.Report this wiki page